capital gains tax changes 2021 canada

Special to The Globe and Mail. Since its more than your ACB you have a capital gain.

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

The above illustration assumes the proceeds of disposition to be 200 with a capital gain of 100.

. No capital gains tax on principal residences. Im interested in 2021 changes in the capital gains tax and the dividend tax credit. For more information see What is the capital gains deduction limit.

Posted on January 7 2021 by Michael Smart. Increasing the capital gain inclusion rate may be one tax change the Canadian government could consider in order to boost tax revenues. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

Published January 12 2021 Updated February 9 2021. As the Government of Canada prepares to present its 2021 budget on April 19 2021 taxpayers should. To address wealth inequality and to improve functioning of our tax.

Tax Changes in 2022. Johns revenue is 910009000. On 29 June 2021 private members Bill C-208 An Act to amend the Income Tax Act transfer of small business or family farm or fishing corporation received Royal.

The taxes in Canada are calculated based on two critical variables. Weve got all the 2021 and 2022. Hunt says the changes still leave Britain with more generous allowances than several other leading nations.

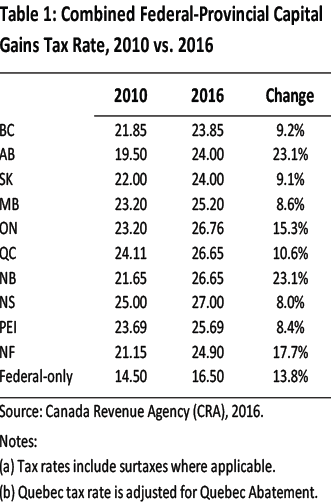

The inclusion rate refers to how much of your capital gains will be taxed by the CRA. As you can see the end result shows that the increase in the capital. The sale price minus your ACB is the capital gain that youll need to.

2 days agoThe Chancellor Jeremy Hunt has halved the capital gains tax threshold taking it from 12300 to 6000. Its time to increase taxes on capital gains. The CPP contribution rate for workers increases to 545 in 2021 or a total of 1090 when combined with the employer.

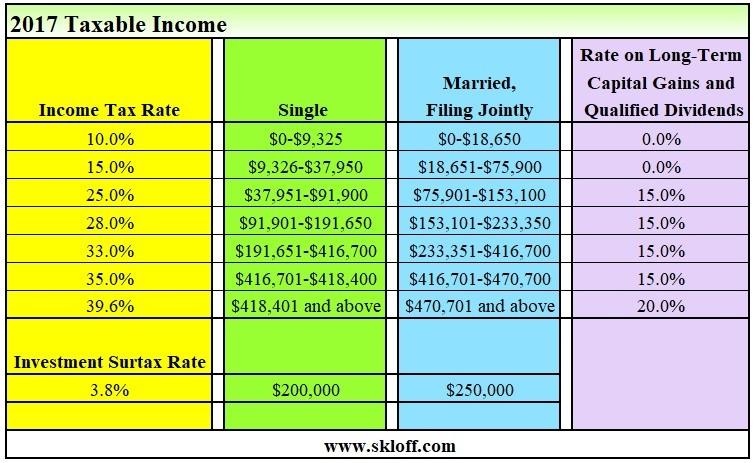

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. You must not make structural changes for rental purposes. 2 days agoChancellor Jeremy Hunt has announced changes to income tax inheritance tax and energy bill support among other measures in todays Autumn Statement.

The 50 percent inclusion rate remained in place until the late 1980s. Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have. On June 18 1987 Finance Minister Michael Wilson announced that the rate would increase to 6623.

Today announced the estimated annual capital gains distributions for the Vanguard ETFs listed below for the 2022 tax year. 2 days agoA hike in capital gains tax rates to equalise them with income taxes had been mooted but Hunt has instead opted to hack back the tax-free allowance and halved it from. As well understanding the typical effective date of changes relative to the Federal.

Canada Pension Plan Contributions in 2022. It will then be cut to 3000 from April 2024. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously. Feb 7 2022. 2 days agoVanguard Investments Canada Inc.

What would be the effect of this investment on his 2021 taxes. Your sale price 3950- your ACB 13002650. This new proposed minimum tax appears to limit the benefits of all credits except for the foreign tax credit and would be calculated as 15 of taxable income for individuals in.

How to prepare for a potential tax hike on capital gains. The annual exempt allowance for capital gains tax will also be cut.

Capital Gains Tax Rate Rules In Canada What You Need To Know

:max_bytes(150000):strip_icc()/TermDefinitions_Capitalgain_finalv1-b039981b63214a4692683b5f10661a01.png)

Capital Gains Definition Rules Taxes And Asset Types

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Income Tax And Capital Gains Rates 2017 04 01 17 Skloff Financial Group

How Are Capital Gains Taxed Tax Policy Center

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

How Are Capital Gains Taxed Tax Policy Center

Analyzing Biden S New American Families Plan Tax Proposal

Jamie Golombek What Tax Changes Might Be Coming Up In The Federal Budget Financial Post

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Short Term And Long Term Capital Gains Tax Rates By Income

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Short Term Capital Gains Tax Rates For 2022 Smartasset

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

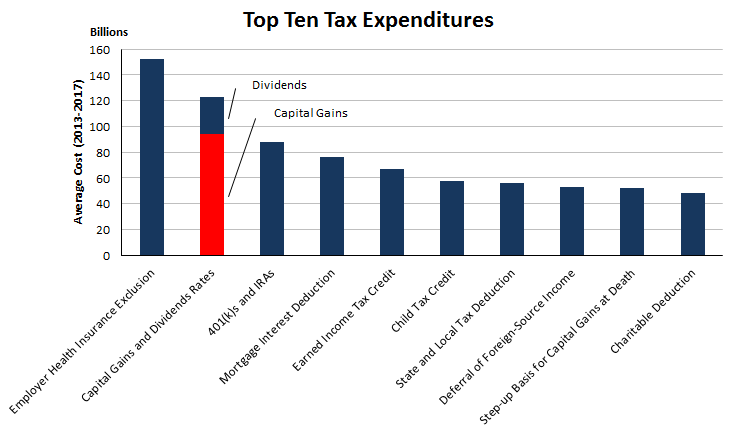

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget